Also published on the Atlantic Monthly’s Business Channel.

With all the accusations of excessive speculation on Wall Street, the media has certainly done its fair share of speculation as to what goes on in the structured finance market. And given all the public outrage, this is information the press should should get straight before they report.

Like every trade, the world of structured finance has developed its own little language describing the things that people in the market do. The first step to understanding that language is building a vocabulary. I would say that most folks in the media have developed to the point where they can identify, point at, and grunt towards objects in the structured finance space. But it’s not just the media that doesn’t understand structured finance. It’s economists, pundits, and perhaps most ironic, financiers! Even that giant of finance, George Soros has loused up explanations of how credit default swaps work. I’ve called out economists in the past for their mumblings on credit default swaps and the like, and so has Megan McArdle. This is a serious problem because economists, finance giants, and the like command a level of authority that my local TV news anchor does not.

Continuing in the tradition of misinformation, it appears Hernando De Soto has joined the ranks of economists who demonstrate a complete lack of understanding of the subject area. But rather than devote an entire article to bashing an intelligent man, I’ve decided to use the errors in his opinion piece in The Wall Street Journal as the first step in exploring the world of structured finance for those (lucky) folks who have hitherto had little exposure to the area.

Speaking Structured Finance

Speaking “Structured Finance” is not as hard as those around you suggest. Sure, these are not ideas and terms you’ve grown up around. But with a bit of reading and thinking, you’ll be the star of your next wine and cheese night. In this article, I provide topical treatment of a wide range of subjects, but provide links for those brave souls who really want to dive in and impress their cheese-eating friends.

First, Mortgage Backed Securities are not derivatives. To my fellow finance wonks, this may be a trivial observation. But apparently Mr. De Soto was not aware of this distinction:

[A]ggressive financiers have manufactured what the Bank for International Settlements estimates to be $1 quadrillion worth of new derivatives (mortgage-backed securities, collateralized debt obligations, and credit default swaps) that have flooded the market.

A Mortgage Backed Security (MBS) is just that, a security and not a derivative. Investors that own MBSs receive regular income from these securities. What distinguishes them from traditional securities, such as corporate bonds, is that the MBS is backed by a pool of mortgages. That is, investors buy MBSs, and as a result, they have a right to the cash flows produced by that pool of mortgages. As the homeowners whose mortgages are in the pool pay off their mortgages, the money gets funneled to and split up among the MBS holders. In effect, MBSs offer investors the opportunity to finance a portion of each mortgage in the pool and receive a portion of the returns on the pool. For more on MBS, go here.

Similarly, a Collateralized Debt Obligation (CDO) is not a derivative, but a security. It is similar in concept to an MBS, except the pool is not made up of mortgages, but rather various debt instruments, such as corporate bonds. The pool underlying the CDO could be made up of loans, in which case it’s referred to as a Collateralized Loan Obligation (CLO). In general, a CDO has a pool of assets that generate cash. As that cash is generated, it gets funneled to and split up among the investors. For more on CDOs, go here and here.

A Credit Default Swap (CDS) is a derivative. So De Soto got 1 out of 3. Well then, what’s a derivative? A “derivative” is a bilateral contract where the value of the contract is derived from some other security, derivative, index, or measurable event. For example, a call option to buy common stock is a fairly well known and common derivative. A call option grants the option holder the right (they can do it) but not the obligation to buy common stock at a predetermined price. The person who sold the option has the obligation (they must do it) and not the right to sell common stock at that predetermined price. So the value of a call option that entitles the holder to buy 100 shares of ABC Co. at $10 per share would depend on the current price of ABC’s stock. If ABC is trading above $10, it would be worth something to the holder, a.k.a., “in the money.” If it’s trading below $10, it would be “out of the money.”

So what are OTC Derivatives? The term “OTC” means “over the counter.” The spirit of the term comes from the fact that OTC Derivatives are not traded on an exchange, but entered into directly between the two parties. “Swaps” are a type of OTC Derivative. And the Interest Rate Swap market is by far the largest corner of the OTC Swap market, despite media protestations as to the size of the CDS market. For more an Interest Rate Swaps, go here.

Despite the fact that the Interest Rate Swap market is an order of magnitude larger than the CDS market, we will succumb to media pressure and skip right past Interest Rate Swaps and onto the most senselessly notorious OTC Derivative of all: the Credit Default Swap.

What Did You Just Agree To?

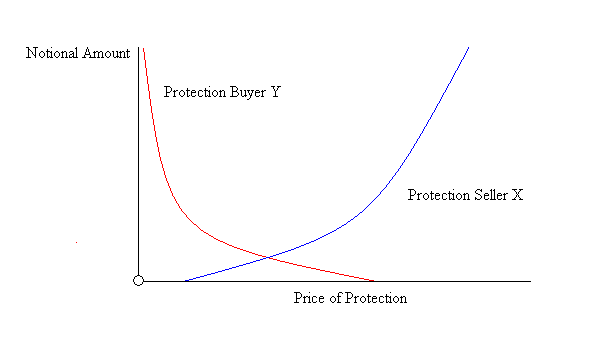

Under a typical CDS, the protection buyer, B, agrees to make regular payments, usually quarterly, to the protection seller, D. The amount of the quarterly payments, called the swap fee, will be a percentage of the notional amount of their agreement. The term notional amount is simply a label for an amount agreed upon by the parties, the significance of which will become clear as we move on. So what does B get in return for his generosity? That depends on the type of CDS, but for now we will assume that we are dealing with what is called physical delivery. Under physical delivery, if the reference entity defaults, D agrees to (i) accept delivery of certain bonds issued by the reference entity named in the CDS and (ii) pay the notional amount in cash to B. After a default, the agreement terminates and no one makes any more payments. If default never occurs, the agreement terminates on some scheduled date. The reference entity could be any entity that has debt obligations.

Now let’s fill in some concrete facts to make things less abstract. Let’s assume the reference entity is ABC. And let’s assume that the notional amount is $100 million and that the swap fee is at a rate of 8% per annum, or $2,000,000 per quarter. Finally, assume that B and D executed their agreement on January 1, 2009 and that B made its first payment on April 1, 2009. When July 1, 2009 rolls along, B will make another $2,000,000 payment. This will go on and on for the life of the agreement, unless ABC triggers a default under the CDS. While there are a myriad of ways to trigger a default under a CDS, we consider only the most basic scenario in which a default occurs: ABC fails to make a payment on one of its bonds. If that happens, we switch into D’s obligations under the CDS. As mentioned above, D has to accept delivery of certain bonds issued by ABC (exactly which bonds are acceptable will be determined by the agreement) and in exchange D must pay B $100 million.

Why Would You Do Such A Thing?

To answer that, we must first observe that there are two possibilities for B’s state of affairs before ABC’s default: he either (i) owned ABC issued bonds or (ii) he did not. I know, very Zen. Let’s assume that B owned $100 million worth of ABC’s bonds. If ABC defaults, B gives D his bonds and receives his $100 million in principal (the notional amount). If ABC doesn’t default, B pays $2,000,000 per quarter over the life of the agreement and collects his $100 million in principal from the bonds when the bonds mature. So in either case, B gets his principal. As a result, he has fully hedged his principal. So, for anyone who owns the underlying bond, a CDS will allow them to protect the principal on that bond in exchange for sacrificing some of the yield on that bond.

Now let’s assume that B didn’t own the bond. If ABC defaults, B has to go out and buy $100 million par value of ABC bonds. Because ABC just defaulted, that’s going to cost a lot less than $100 million. Let’s say it costs B $50 million to buy ABC issued bonds with a par value of $100 million. B is going to deliver these bonds to D and receive $100 million. That leaves B with a profit of $50 million. Outstanding. But what if ABC doesn’t default? In that case, B has to pay out $2,000,000 per quarter for the life of the agreement and receives nothing. So, a CDS allows someone who doesn’t own the underlying bond to short the bond.

So why would D enter into a CDS? Most of the big swap dealers buy and sell protection and pocket the difference. But, D doesn’t have to be a dealer. D could sell protection without entering into an offsetting transaction. In that case, he has gone long on the underlying bond. That is, he has almost the same cash flows as someone who owns the bond. So a CDS allows someone who doesn’t own the bond to gain bond-like credit exposure to the reference entity.

I will follow this article up with another elaborating further on why derivatives are used and why they are your friends.

[IMAGES REMOVED BY UST; SEE REPORT LINK BELOW]

[IMAGES REMOVED BY UST; SEE REPORT LINK BELOW]

Depending on whether the synthetics are fully funded or not, the principle investment will go to the Treasuries market or back into the capital markets respectively. Note that synthetic MBSs can exist only when there is a protection buyer for the CDS that comprises part of the synthetic. That is, only when interest rates on MBSs drop low enough, along with the price of protection on MBSs, will protection buyers enter CDS contracts. So when protection buyers think that interest rates on MBSs are too low to reflect the actual probability of default, their desire to profit from this will facilitate the issuance of synthetic MBSs, thereby diverting cash from the mortgage market and into either Treasuries or other areas of the capital markets. Thus, the existence of CDSs operates as a safety valve on the issuance of MBSs. When interest rates sink too low, synthetics will be issued, diverting cash away from the mortgage market.

Depending on whether the synthetics are fully funded or not, the principle investment will go to the Treasuries market or back into the capital markets respectively. Note that synthetic MBSs can exist only when there is a protection buyer for the CDS that comprises part of the synthetic. That is, only when interest rates on MBSs drop low enough, along with the price of protection on MBSs, will protection buyers enter CDS contracts. So when protection buyers think that interest rates on MBSs are too low to reflect the actual probability of default, their desire to profit from this will facilitate the issuance of synthetic MBSs, thereby diverting cash from the mortgage market and into either Treasuries or other areas of the capital markets. Thus, the existence of CDSs operates as a safety valve on the issuance of MBSs. When interest rates sink too low, synthetics will be issued, diverting cash away from the mortgage market.